Irs 401k Hardship Withdrawal Rules

Irs 401k Hardship Withdrawal Rules. The middle bar shows the resulting. That could mean giving the government.

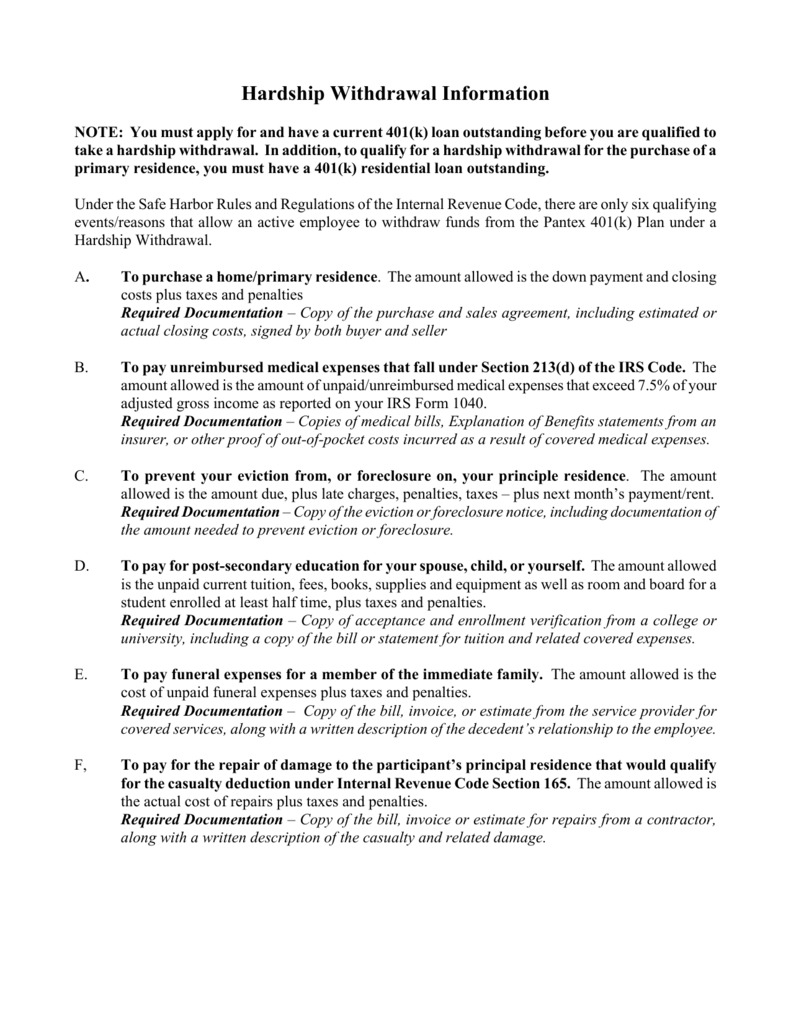

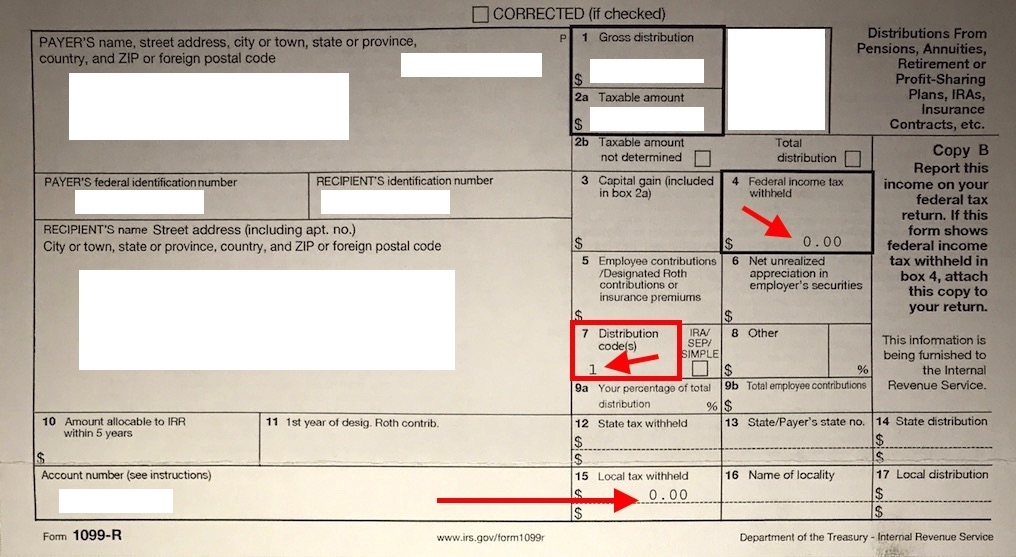

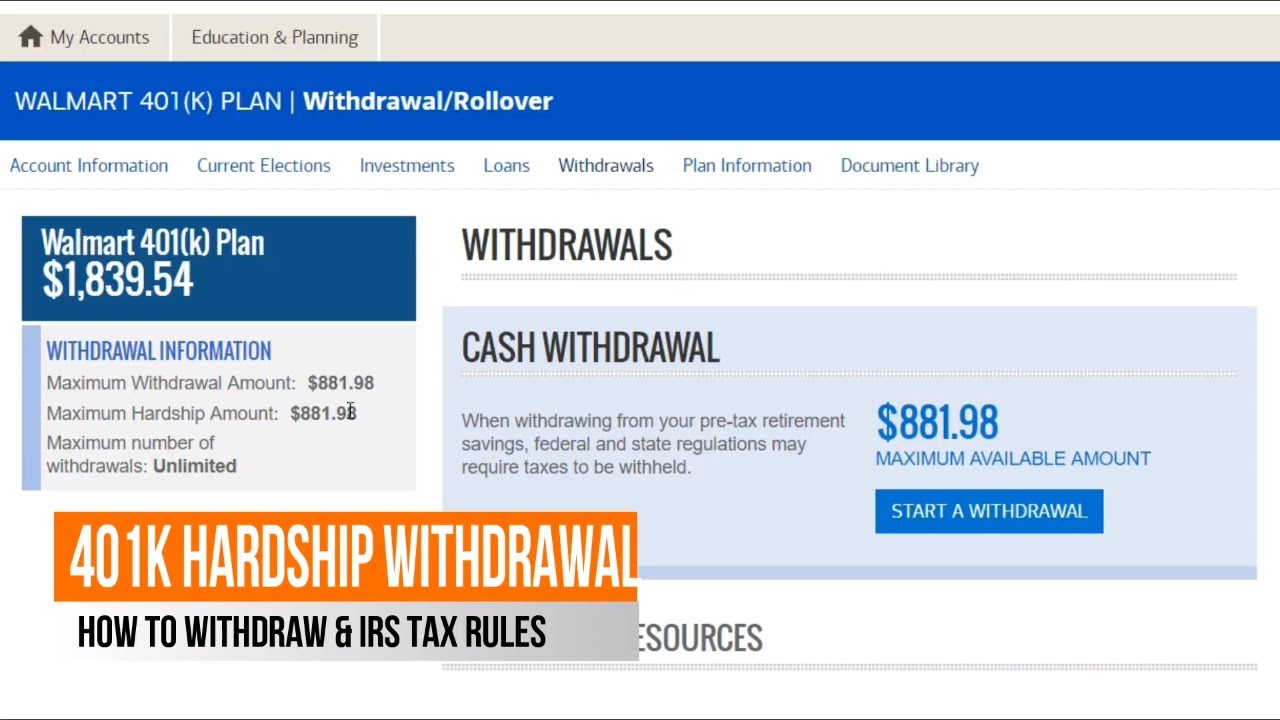

12, 2019, establishes the deadline for amending 401(k) plans to comply with the new hardship withdrawal rules. — if you do find yourself in a situation where it’s unavoidable to withdraw funds from your 401(k) early, there is something called a 401(k) hardship withdrawal that might allow you.

Irs 401k Hardship Withdrawal Rules Images References :

/what-to-know-before-taking-a-401-k-hardship-withdrawal-2388214-v2-211c0d162ae64a95bbe3813f1f9243ad.png) Source: www.thebalance.com

Source: www.thebalance.com

401(k) Hardship Withdrawals—Here's How They Work, The middle bar shows the resulting.

Source: blinnibdevonna.pages.dev

Source: blinnibdevonna.pages.dev

Irs Hardship Withdrawal Rules 2024 Karel Lettie, Employers are not required to allow hardship withdrawals, so access can vary from.

Source: www.youtube.com

Source: www.youtube.com

401(k) Hardship Withdrawal 101 Understanding the Rules and Regulations, Whether you can take a hardship distribution from your 401 (k) or 403 (b) plan —and for which reasons—is up to the employer who.

Source: mauriziawbritta.pages.dev

Source: mauriziawbritta.pages.dev

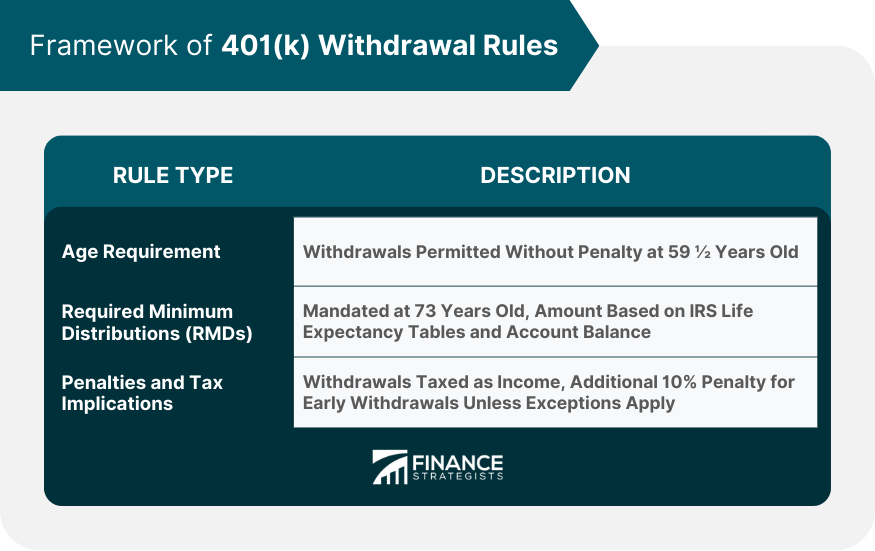

401k Withdrawal Rules 2024 Lexie Opalina, — if you withdraw money from your 401 (k) before you’re 59½, the irs usually assesses a 10% tax as an early distribution penalty.

The Rules of a 401(k) Hardship Withdrawal, For a distribution from a 401(k) plan to be on account of hardship, it must be made on account of an immediate and heavy financial need.

Source: www.sgrlaw.com

Source: www.sgrlaw.com

Final Regulations Update 401(k) Hardship Withdrawal Rules SGR Law, For example, some 401(k) plans may allow a hardship distribution to pay for your, your spouse’s, your dependents’ or your primary plan.

Source: becomethesolution.com

Source: becomethesolution.com

How To 401k Hardship Withdrawal Step by Step, That could mean giving the government.

Source: www.coastalwealthmanagement24.com

Source: www.coastalwealthmanagement24.com

What are the new rules for 401(k) hardship withdrawals? Coastal, For example, some 401(k) plans may allow a hardship distribution to pay for your, your spouse’s, your dependents’ or your primary plan.

Source: www.youtube.com

Source: www.youtube.com

WALMART 401K HARDSHIP WITHDRAWAL WITH MERRILL LYNCH & IRS TAX RULES, What you need to know about the new regulations on 401 (k) hardship distributions.

Source: gbu-taganskij.ru

Source: gbu-taganskij.ru

401k Hardship Withdrawal Rules What Is It And Should You Do, 52 OFF, — according to the irs, there must be an “immediate and heavy financial need” for a 401(k) hardship withdrawal.

Category: 2024